Features of True Balance – Personal Loan App:

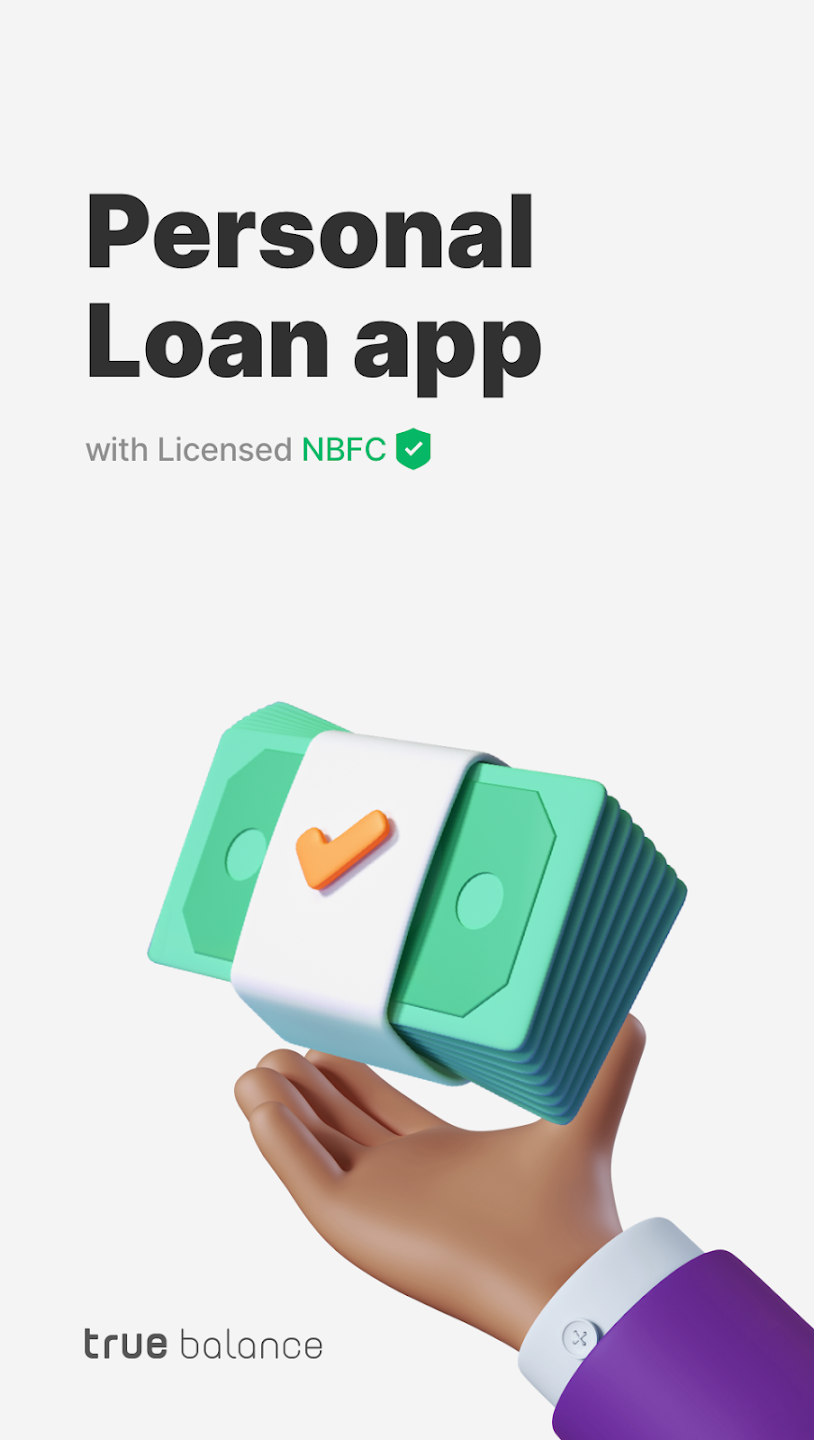

- Personal Loans from 5,000 to 50,000 Rupees

- No paper loan application

- Access to personal loans and money 24 hours a day, 7 days a week

- Low processing fee, longer repayment term, and appealing interest rate

- Loan disbursed directly to your bank account

- Pan-India access

- Convenient payment options

- Paying back your personal loan on time improves your credit score and allows you to borrow more money.

- The Repay Later option lets you pay back a portion of the loan on the due date and extend the repayment term multiple times.

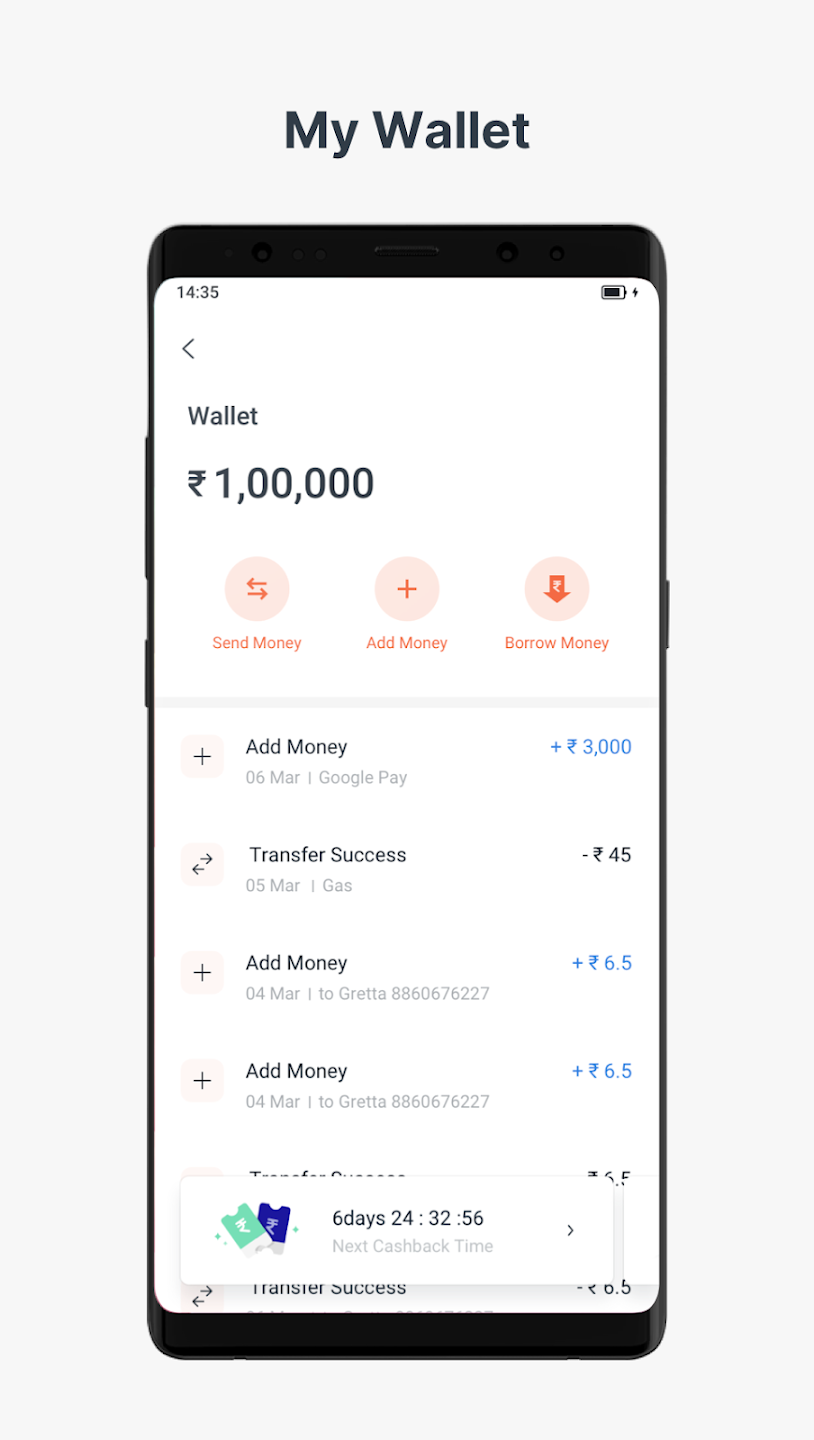

True Balance has a PPI license and offers an RBI-compliant Wallet as well as a variety of payment options, including Net banking, credit cards, debit cards, and gift cards. Additionally, True Balance has partnered with NBFCs to offer online personal loans.

How to apply for a personal loan on True Balance?

Download the True Balance app

Register with your contact number to access the True Balance personal loan app

Fill in your basic information to determine your eligibility for a personal loan

Submit KYC documents and apply for an instant loan

Once the application is approved, we transfer the loan directly to your bank account.

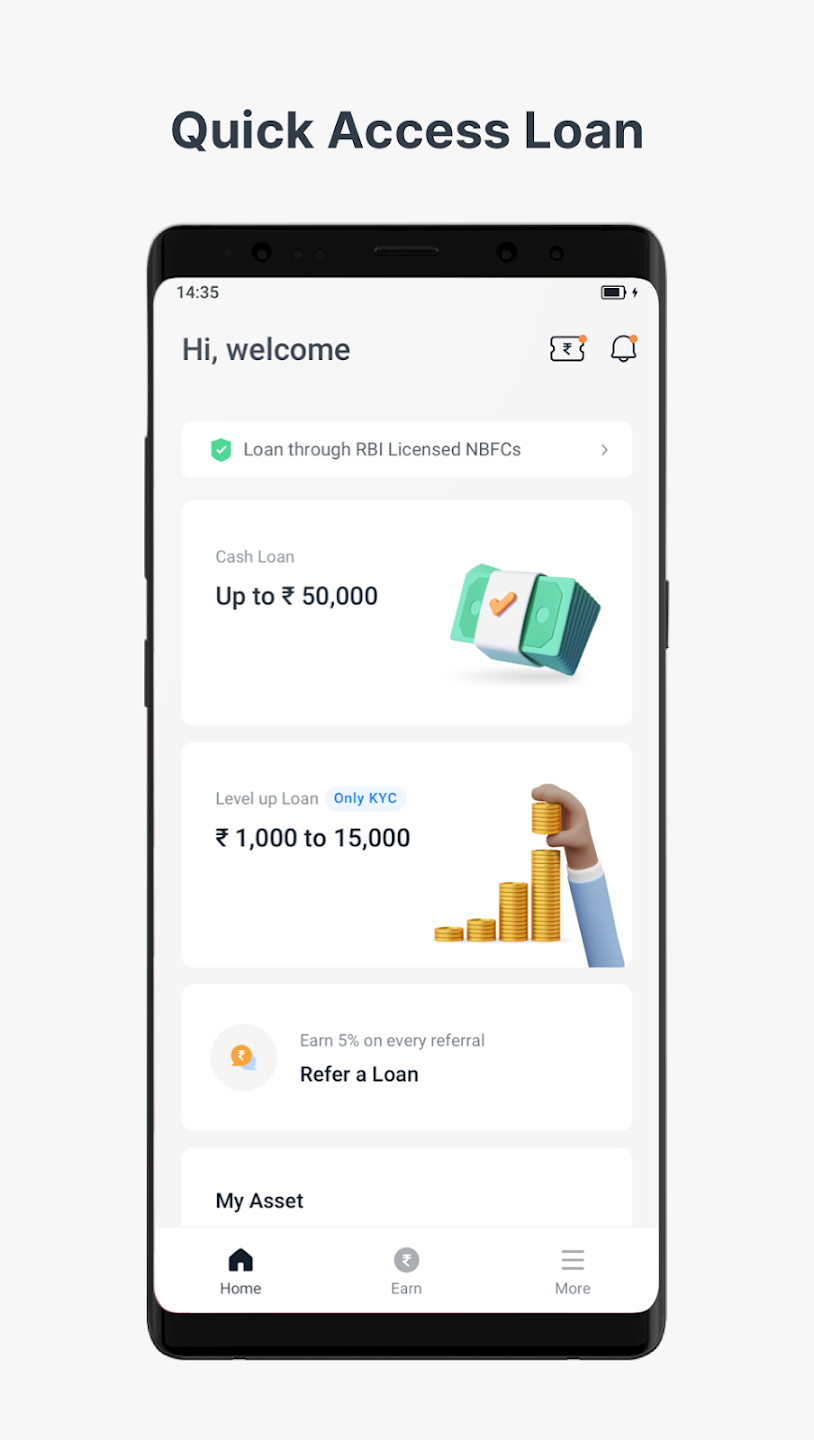

A quick look at the other services that True Balance App offers

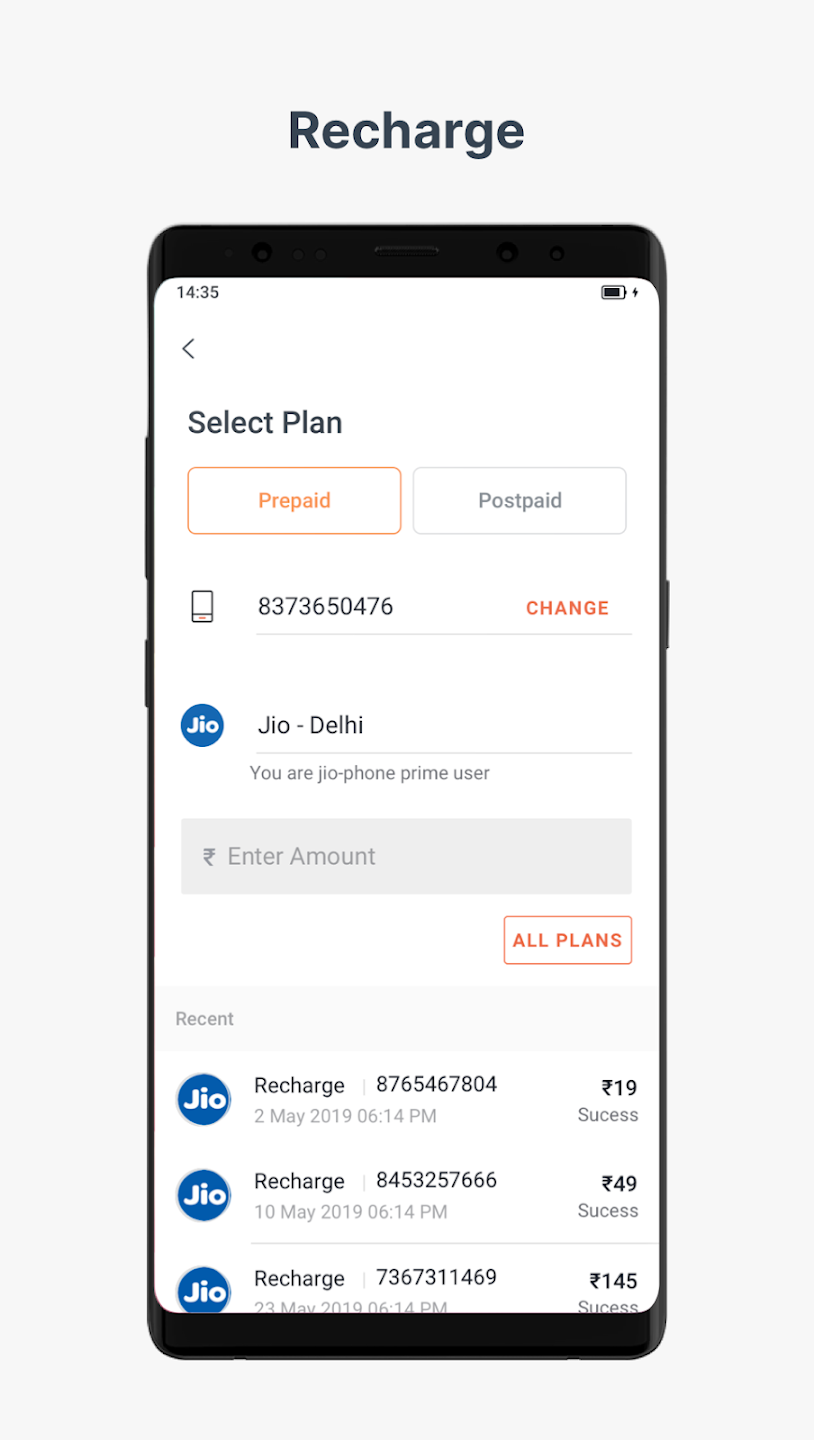

Prepaid and Postpaid payment

• Super-fast recharges of any amount between 10 and 2595 rupees on the network of five leading operators

• Earn Cashback on Prepaid and Postpaid recharges

DTH, gas pipes, electricity, water, LPG, and paying bills

DTH recharge is accessible to all five major operators. Each month, earn cash back.

• 30 water meters, 24 gas pipes, three LPG cylinders, and 54 electricity boards

Please Note

• That completing the full KYC will maximize your Cashback benefits.

• Cashback in any form cannot be transferred and can only be used within the app.

App permissions & reasons:

• The location to inform you of the appropriate plan for your area or circle.

• Contact to automatically fill in data and find references.

• Transactional SMS to verify the phone number for registration only

• Camera is required for the entire KYC process;

• Calendar is used to send reminders about due dates;

• Phone is used to collect information about the hardware model, operating system, and version, as well as network information, and to prevent fraud by preventing unauthorized devices from acting.

SAFE AND SECURE LOANS

It has a 4.0+ star rating, making it one of the best online loan apps in India. The entire process is done online and is safe.