Friends, in today’s time some people want that they should do some part time work along with their job. But in today’s time it is not necessary that you have to work outside only, you can also work from your mobile. That’s why today we have brought such an app for you so that you can easily do part time earning by using this app anywhere, anytime. You can easily earn from ₹ 500 to ₹ 1000 in a day. You can take the help of these apps to hand-le your daily expenses and you can easily cover your pocket money.

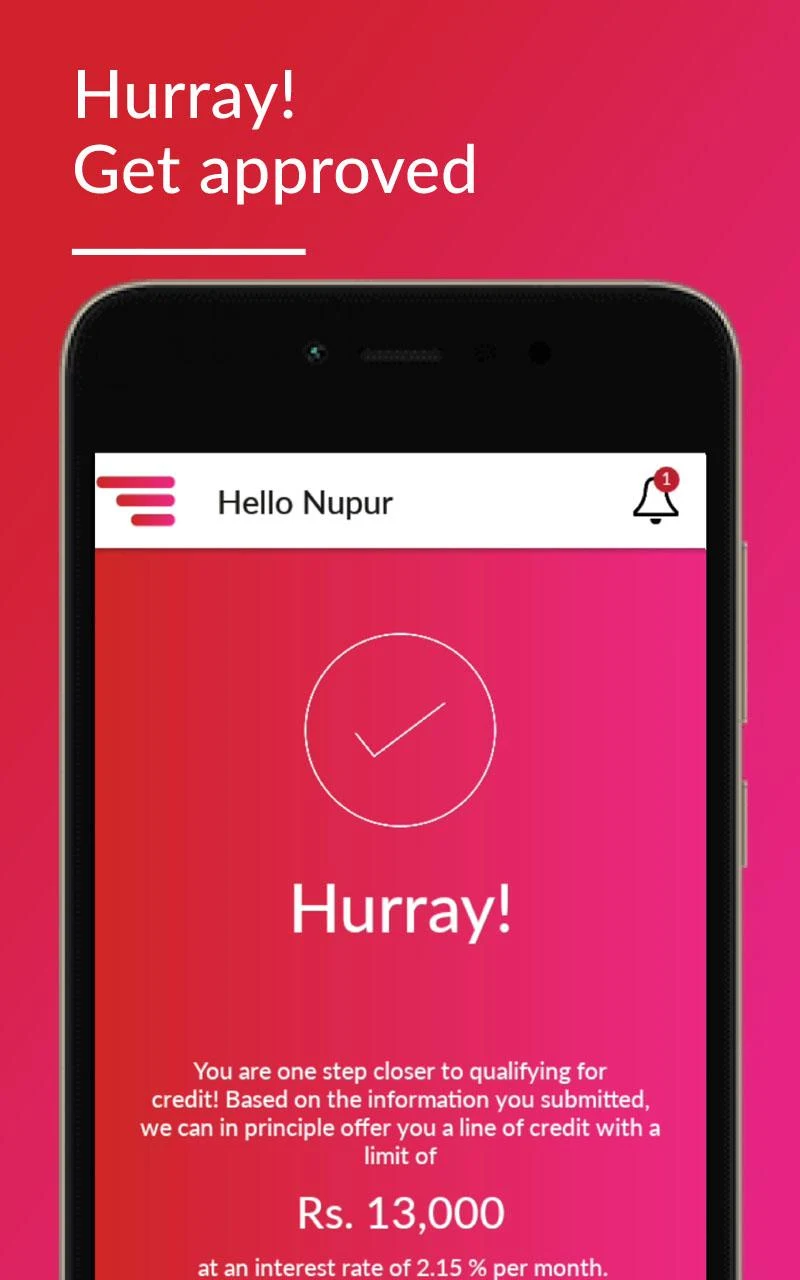

NIRA Instant Personal Loan App

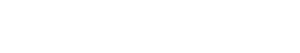

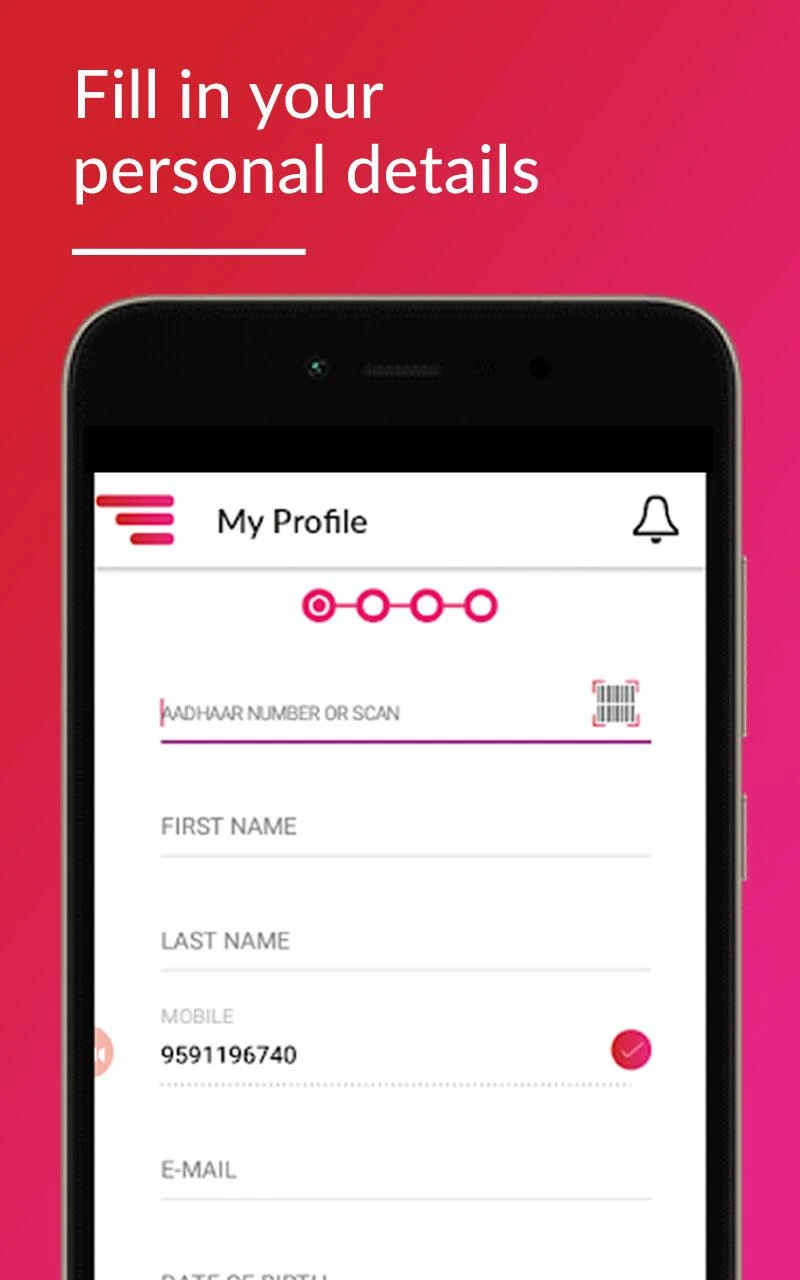

To facilitate loans for salaried individuals, NIRA collaborates with various NBFCs and banks that are regulated by the RBI.

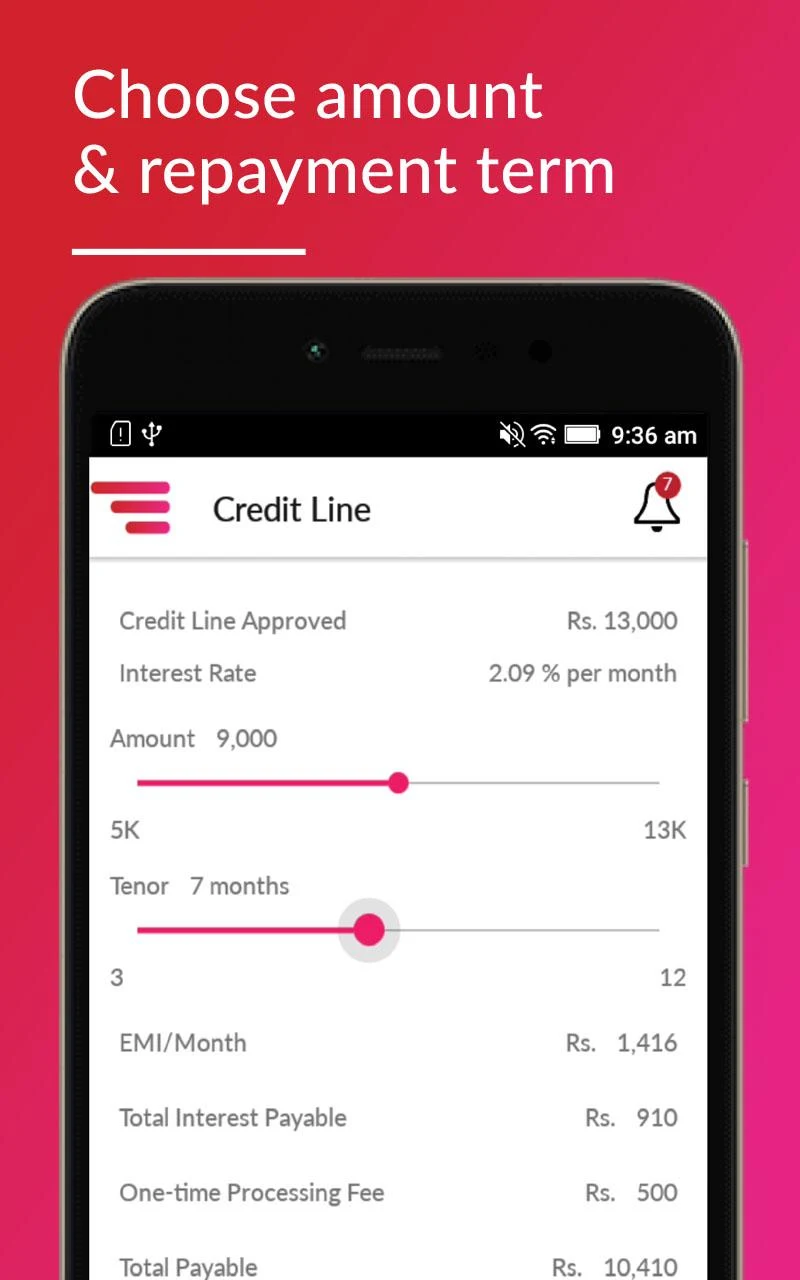

Important Information Regarding the NIRA Loan Application Loan Amount: Minimum Annual Percentage Rate (APR): Rs 5,000 to Rs 1,00,000 Maximum Annual Percentage Rate: 24 percent 36 percent (reducing balance) Minimum repayment time: Maximum repayment period: 91 days Fees for processing for a year: Prepayment Fees: Up to 2%-7% of the loan amount (plus GST) Zero within seven days of disbursement, thereafter 4% of the prepayment amount. Late fee: You will be charged Rs. 500 if the overdue amount is greater than 30 days. If the due date is later than 90 days, there will be a maximum late fee of Rs. 1000. In the event of a bounce, your bank might also charge you money.

A good illustration of the total cost of the loan is:

✔ Amount Borrowed (Principal): 14,999 Yuan

✔ Interest Rate (APR): 36 percent (based on the calculation of the interest on the principal balance reduction)

✔ Duration: six months

✔ Processing Fee (includes GST) = 826

✔ The amount paid out = 14,173

✔ Your EMI (based on the PMT method, a sample monthly payment) = 2769

✔ The interest amount = 2769 x 6 – 14999 = 1614 (based on a sample interest calculation);

✔ The late fee is 0 if paid on time

✔ The total cost of the loan is 2440

✔ The principal repayment amount is the same as the amount borrowed

✔ The total repayment amount is the principal repayment amount plus the interest amount plus the fee is 14