Friends, in today’s time some people want that they should do some part time work along with their job. But in today’s time it is not necessary that you have to work outside only, you can also work from your mobile. That’s why today we have brought such an app for you so that you can easily do part time earning by using this app anywhere, anytime. You can easily earn from ₹ 500 to ₹ 1000 in a day. You can take the help of these apps to hand-le your daily expenses and you can easily cover your pocket money.

Navi App

Navi, the ultimate superapp created specifically for your specific financial requirements, ushers in a new era of financial ease. Explore a comprehensive selection of services, including quick cash loans, dependable health insurance, and simple home loans, as well as smart investments in gold and mutual funds. Navi is here to make it easy for you to take control of your future by simplifying your financial journey. With the Navi app, you can confidently explore a world of financial wellbeing options.

The Navi app provides

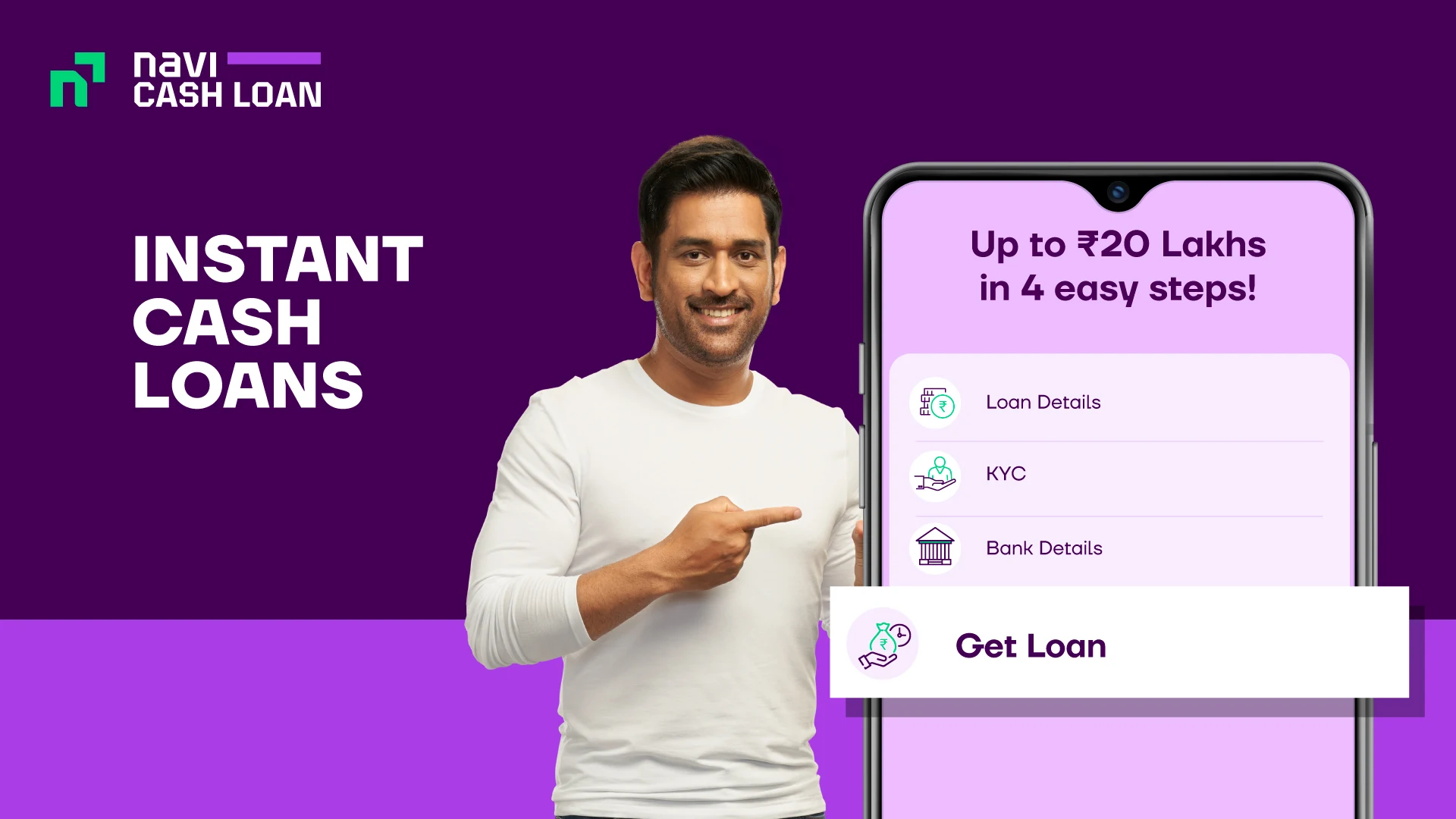

1. Digital gold and a variety of mutual funds, including the Navi Nasdaq 100 Fund of Fund and the Navi Nifty 50 Index Fund, are two examples of mutual fund investments.

Highlights of Navi Mutual Fund:

Diversification with a variety of domestic and international funds, a low expense ratio, and investment options starting as low as 10 Navi Gold features:

24K Digital Gold 99.9% purity Lowest price on the market Investment with as little as 1 *Investments in mutual funds involve market risks. Carefully read all documents pertaining to the scheme.

Health Insurance

Navi Health care coverage application gives a far reaching health care coverage plan which protects your family’s monetary future with up to ₹1 crore cover.

Features and Benefits of Health Insurance:

Coverage up to 1 crore; Premium starting at 235 per month; 20-minute cashless claim settlement at 10,000+ network hospitals; 100% hospital bill coverage; 100% paperless process; Facilities for insurance top-up and porting

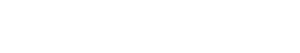

Cash Loan

The Navi app lets you get an instant cash loan of up to 20 lakh. You can choose from a wide range of repayment terms, ranging from three to seventy-two months, and our APR ranges from 9.9% to 45%*.

Advantages and Features of a Personal/Cash Loan:

Amount of Loan: Rate of Interest: Up to 20% Starting at 9.9% and going up to 45% per year Three to seventy months; a process that is entirely digital; an immediate transfer of funds to your bank account; a minimum income for the household: 3,00,000 per month with no security deposit An illustration of the Navi Cash/Personal Loan process:

Loan Amount: 50,000 Yuan Term: 12 Months Interest Rate: 22% (based on reducing principal balance interest calculation) EMI: 4,680 Yuan Total Interest Payable: 4,680 Yuan x 12 Months = 50,000 Yuan Principal = 6,160 Yuan GST) – 1,475 yen Disbursed Amount – 50,000 yen – 1,475 yen Total Amount Payable – 4,680 yen x 12 months = 56,160 yen Total Cost of the Loan = Interest Amount + Processing Fees = 6,160 yen – 1,475 yen

Home Loan

On the Navi Home Loan app, you can get a loan of up to 5 crore at an attractive interest rate of 8.74 percent per annum and flexible EMI options. Home Loan Features and Benefits Loan Amount: Rate of Interest Up to 5 Crore: beginning at 8.74 percent per annum

Loan Duration: Navi Home Loan is available in Mumbai, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Pune. It offers up to 30 years, zero processing fees, and a paperless application process.

About Navi Technologies Limited, founded in December 2018 by Sachin Bansal and Ankit Agarwal, which developed and owns the Navi app

Navi Finserv Limited, an RBI-registered and regulated Non-Deposit Taking Systemically Important NBFC, provides the Cash Loans and Home Loans.

Navi General Insurance Limited, a general insurer registered with the IRDA, provides health insurance.

Lovely blog! I am loving it!! Will come back again. I am bookmarking your feeds also

Thanks Zoritoler