Friends, in today’s time some people want that they should do some part time work along with their job. But in today’s time it is not necessary that you have to work outside only, you can also work from your mobile. That’s why today we have brought such an app for you so that you can easily do part time earning by using this app anywhere, anytime. You can easily earn from ₹ 500 to ₹ 1000 in a day. You can take the help of these apps to hand-le your daily expenses and you can easily cover your pocket money.

CASHe Personal Loan App

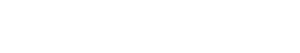

Hello friends, how are you, if you are also worried, you need money very much and you are not getting any loan, then today we have brought a very good platform for you, from which you can take loan from your mobile sitting at home. We are talking about CASHe app, which is always used in your bank account. This is a very good personal loan app. Which lets you experience the benefits of an instant personal loan ranging from Rs 1,000 to Rs 4,00,000 with instant transfer to your bank account

CASHe is an app that provides a smart, intuitive and hassle-free experience. Apply for a loan here today and enjoy a superior borrowing experience.

CASHe adheres to the Fair Practice Code of RBI and is committed to promote best practices in digital lending. there is no risk of any kind

Important Nots

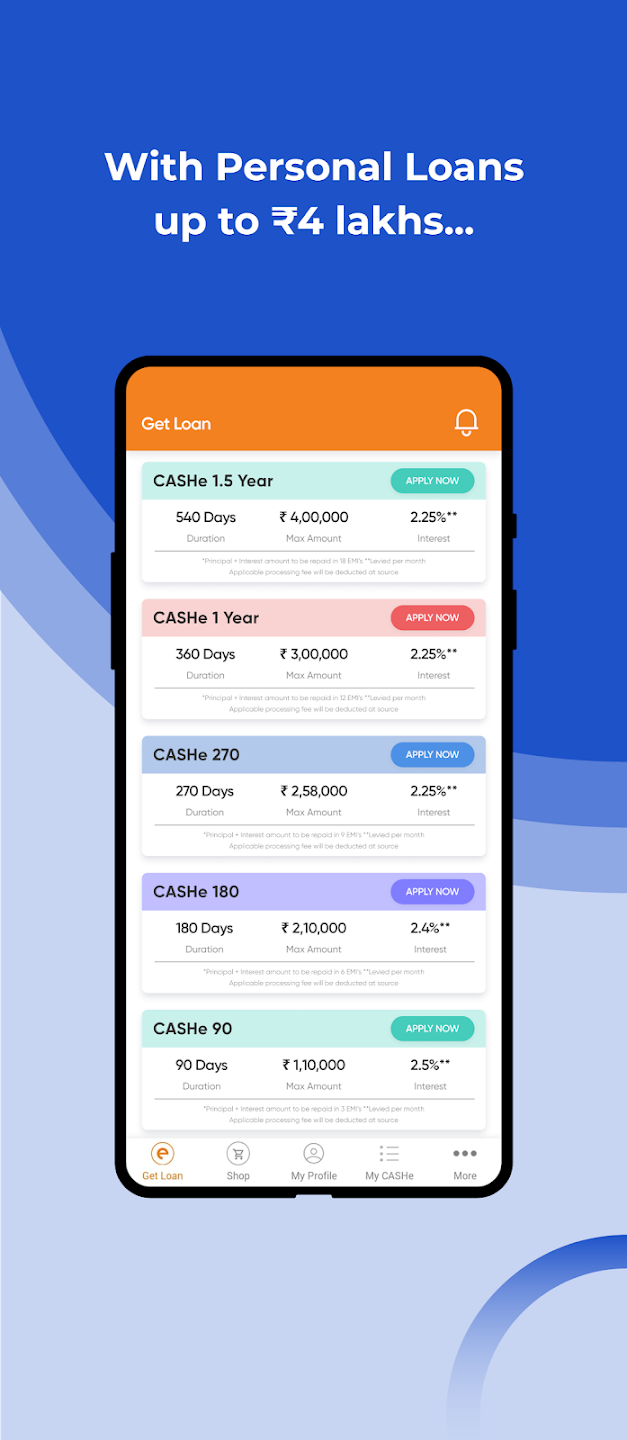

One approval, multiple loans with the CASHe Credit Line. Apply for a credit line with a one-year term and minimal documentation to get short-term loans for emergencies and shopping.

Buy Now, Pay Later with CASHe With the CASHe pay later app, you can get an online shopping loan with no interest on top brands like Amazon, Flipkart, Big Basket, Apollo Pharmacy, Uber, and Myntra. With simple EMIs, you can pay your bills later.

Individual Credit Qualification:

• Only salaried professionals are eligible for a personal loan • Monthly net take-home pay of no less than: 12,000 • Over the age of 21 • Only available for direct bank transfer of salary Features of the CASHe – Personal Loan App:

• Choose from a variety of personal loans • Conduct a personal loan eligibility check • Provide personal loans ranging from 1,000 to 4,00,000 • Quickly apply for a loan through the online loan app • Repayment terms of more than three months • No guarantors or collaterals • 100% paperless loan application • No foreclosure fees • Provide instant credit line • Enjoy online shopping at no cost EMI* • Receive a loan that is immediately credited to your bank account • Repay the loan using a It is the best Indian online personal loan app and easy to use.

Make use of the CASHe app to obtain a credit line or a personal loan of up to 4,00,000 yen online. Quickly determine your eligibility for a personal loan and make an easy application.

15 million+ clients have downloaded the CASHe individual credit application. Download the application to encounter a better approach for getting!

How do I use CASHe to apply for a personal loan online?

• Introduce CASHe application

• Sign in to CASHe individual advance application by enrolling through your virtual entertainment account

• Fill in essential subtleties to know your own credit qualification

• Submit KYC records and apply for fast private credit

• Whenever application is endorsed, we move the credit straightforwardly to your ledger

Records expected to apply for a credit:

• Selfie • PAN card • ID proof (any one of the following: driving license, voter ID, passport, or Aadhaar card) • Address proof (any one of the following: driving license, voter ID, passport, or Aadhaar card/utility bills) • 3-month bank statements with salary credit • Aadhaar card (optional) 90 days

• Most extreme Reimbursement Residency: 18 months • CASHe 540 – The fee for processing: 3% or 1000, whichever is higher

• CASHe 180, CASHe 270, CASHe 1 year – Handling expense: 2 percent or $1,200, preferably more. • CASHe 90 – Processing fee: 1.5% or 500, preferably higher, NBFCs and banks with which we collaborate:

• Bhanix Money and Venture Restricted