Friends, in today’s time some people want that they should do some part time work along with their job. But in today’s time it is not necessary that you have to work outside only, you can also work from your mobile. That’s why today we have brought such an app for you so that you can easily do part time earning by using this app anywhere, anytime. You can easily earn from ₹ 500 to ₹ 1000 in a day. You can take the help of these apps to hand-le your daily expenses and you can easily cover your pocket money.

About MobiKwik:

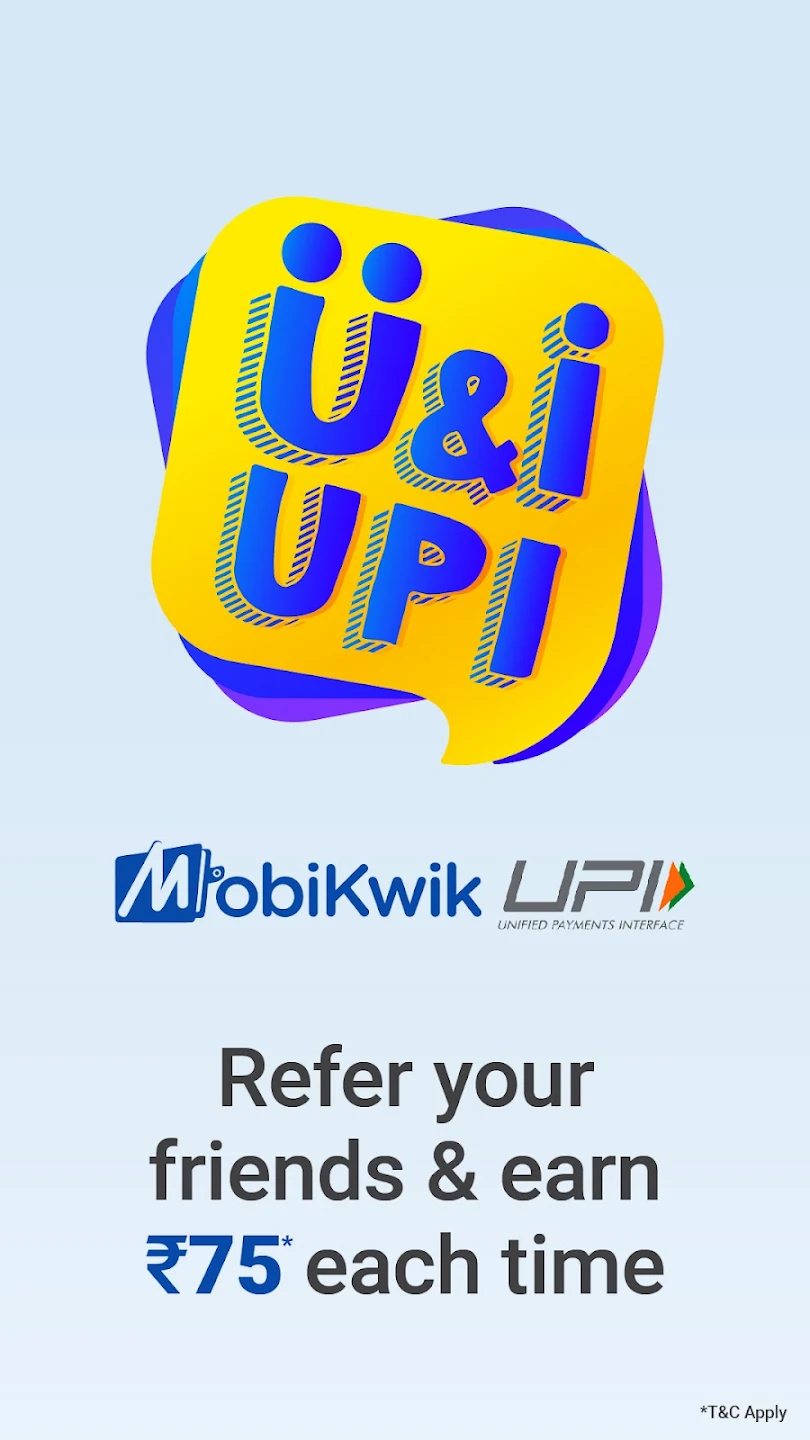

MobiKwik is a payment app that meets all of your day-to-day payment needs, such as getting a credit of up to 60,000 yen for “Spend Now & Pay Later,” using UPI to pay bills, recharging mobile phones, using prepaid or postpaid plans, paying your electricity bill, transferring money, using BHIM UPI, paying your DTH bill, broadband bill, credit card bill, and more.

The app also lets you invest in gold, mutual funds, and a lot more!

You can save up to 1,000 each month by using SuperCash, our loyalty points.

Make instant recharges, bill payments, and transactions at more than a million brands, including IRCTC, Zomato, Swiggy, and Xiaomi, with MobiKwik. We also safeguard your data. Get started by signing up with your phone number!

Zip Pay Later:

– Shop more than a million brands with a credit of up to 60,000 yen.

– Get free credit to buy now and pay later!

– The limit is based on how much you use it; the more you use it, the higher your credit limit will be.

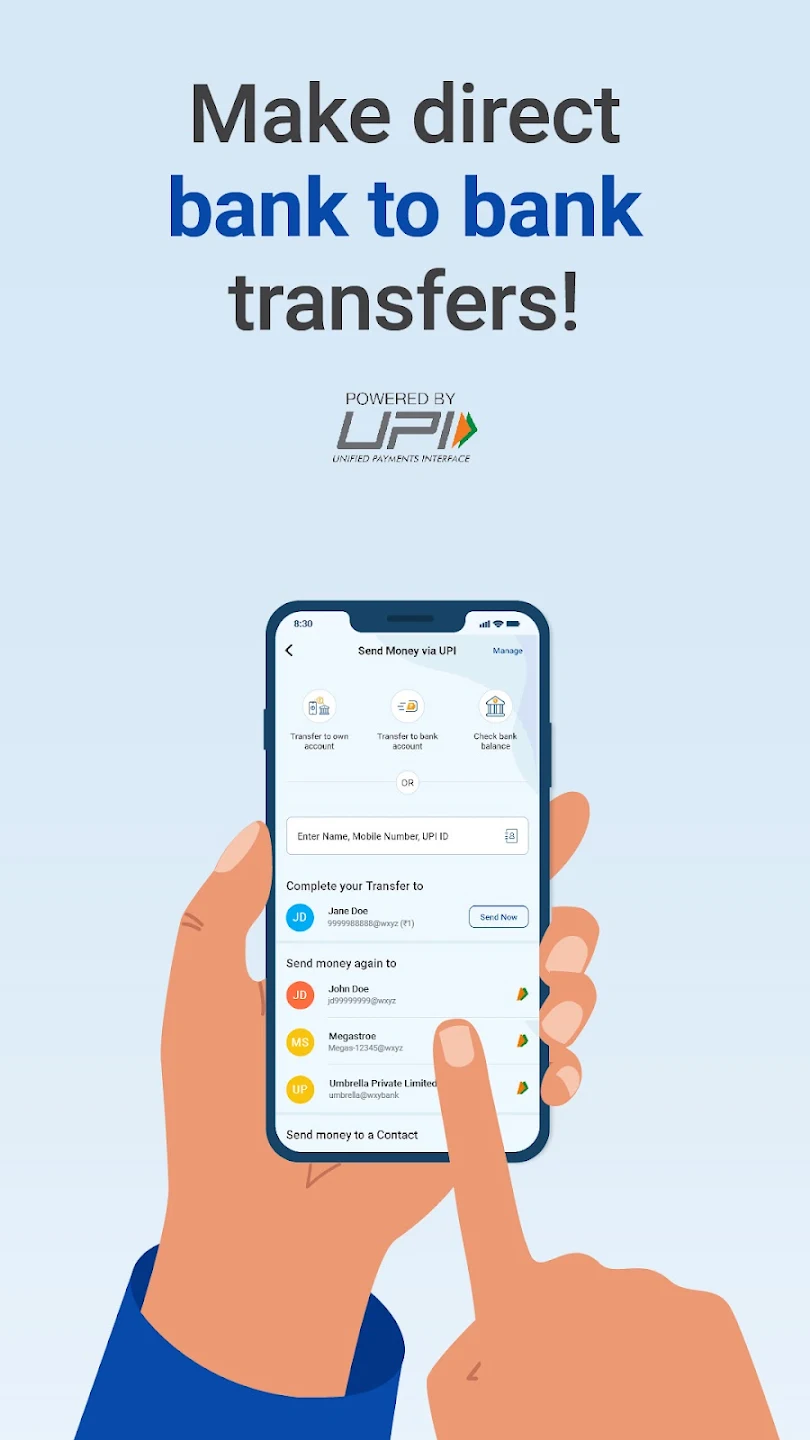

Money Transfer:

– Send money instantly to all banks.

– Move money from one account at a bank to another, from one wallet to another, and from a card to a bank.

– Immediately transfer funds to your bank account from your credit card.